US President Donald Trump has fired a social media message calling on the head of a US technology company to step down from his post as CEO.

Trump’s decision to denounce Intel CEO Rip Beau Tan on Thursday morning caused a company’s stock to fall amid uncertainty about the future of leadership.

“Intel CEOs are in great conflict and must resign immediately,” Trump wrote. “There is no other solution to this problem. Thank you for paying attention to this problem!”

Trump’s post appeared to be the response to a report that TAN invested around $200 million in Chinese technology manufacturing and chip companies.

But the president’s social media message also raises concerns about his apparent willingness to take part in private business operations in search of a dramatic change in leadership and direction.

A detailed investigation into China’s relationship with Tan

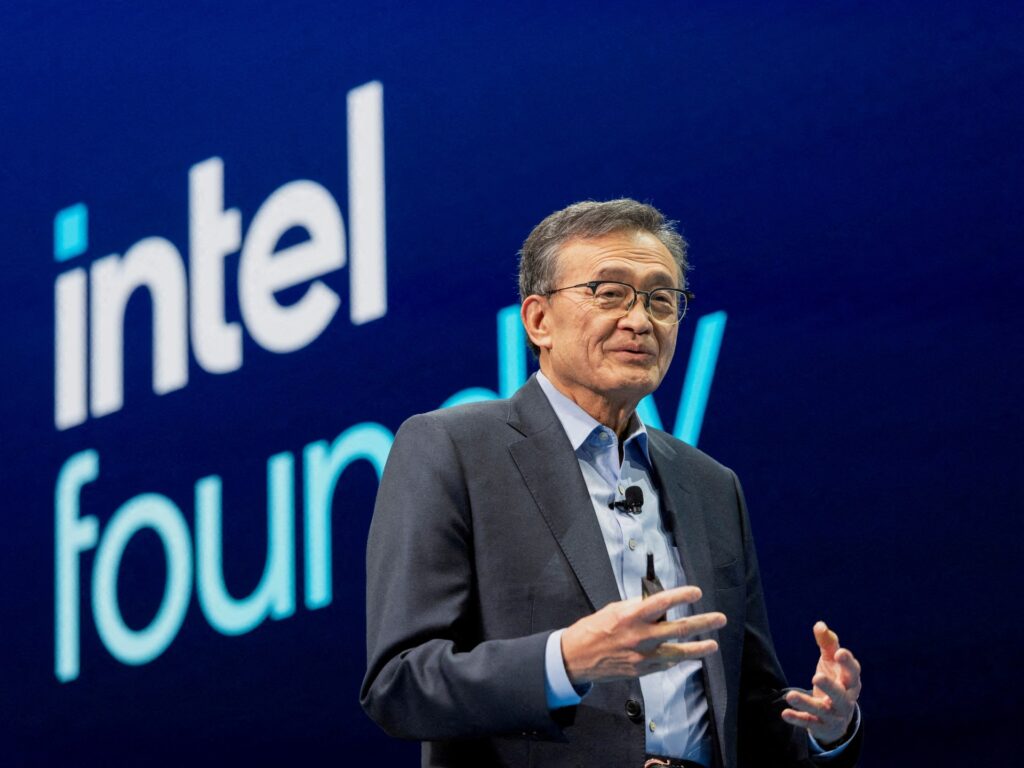

Longtime tech investor, Tan is relatively new to his post. He was appointed CEO of Intel on March 12th and also serves on the company’s board of directors.

Previously, Tan held a leadership position at software company Cadence Design Systems, where he was a founding partner of venture capital firm Walden Catalyst Ventures.

However, his personal investments and the venture funds he manages attracted public attention shortly after his appointment at Intel.

In April, news outlet Reuters reported that between March 2012 and December 2024, TAN invested in Chinese companies and created technology for the People’s Liberation Army, the Chinese military.

For some American politicians, it raised conflicts of interest.

For example, on Wednesday, Republican Sen. Tom Cotton from Arkansas posted a letter on social media written to chairman Frank Yearly, Intel’s board of directors.

In it, he requested more information about Tan’s employment and investment in China.

Cotton noted that on July 28, Cadence Design Systems agreed to plead guilty to a federal complaint regarding the sale of technology and intellectual property to China’s National University of Defense Technology.

The plea deal has resulted in more than $140 million in criminal and civil penalties.

“I am writing to express my concern about the safety and integrity of Intel’s business and the potential impact on the national security of the United States,” Cotton wrote to Yeary in his letter.

“Tang is reportedly controlling dozens of Chinese companies and has stakes in hundreds of advanced Chinese manufacturing and chip companies. At least eight of these companies are reportedly linked to the People’s Liberation Army.”

In a message attached to his social media followers, Cotton added that Intel “owes an explanation to Congress.”

Intel responded to the allegations on Thursday, saying that both the company and Tan have been “deeply committed” to promoting US national security and economic prosperity.

“Intel has been manufacturing in the United States for 56 years,” he said in a statement. “We continue to invest billions of dollars in domestic semiconductor research and development (R&D) and manufacturing.”

Trump pushes “America’s first” plan

For years, the US and China have been locked in tense competition for economic and political domination, with the US repeatedly accusing China of poaching American innovations and spying on its tech companies.

Meanwhile, China has denied such allegations and described them as part of the US smear campaign.

Founded in 1968, Intel has long been a flagship US technology company known for producing computer parts such as microprocessors. However, in recent decades, the company has struggled to keep pace with its competitors, especially as artificial intelligence (AI) transformed Intel’s long-time home, Silicon Valley.

But Trump tried to bolster domestic manufacturing with his “America First” economic agenda. It utilizes tariffs to prevent importing products from overseas.

On Tuesday, Republican leaders even said they were planning to impose 100% tariffs on foreign chips and semiconductors sold in the US.

But Trump faces criticism for testing the boundaries of his enforcement, and in some cases he is trying to impose his will on running a private company.

For example, since taking office in his second term, Trump withheld federal funds from private universities to ensure that those institutions remove diversity initiatives and implement disciplinary reforms and more.

In an interview with Reuters, analysts appeared to have split over whether Trump was overestimating his hands.

“Many investors may think President Trump has gotten too many cookie jars, and that’s just that he’s very serious about trying to get his business back in the US,” said David Wagner, head of equity and portfolio manager at Aptus Capital Advisors, who invested in Intel.

Meanwhile, Phil Blancato, CEO of Ladenburg Thalmann Asset Management, told Reuters that Trump’s banishment of Tan could have a calm impact on American businesses.

“It would set a very unfortunate precedent,” Blankert said. “You don’t want the US president to direct who runs the company, but there is certainly merit and weight to his opinion.”

It is unclear how Trump’s pressure campaign against Tan will affect Intel’s future.

However, in that statement, Intel said it was “a significant investment that is consistent with the President’s first American agenda.”

“We look forward to continuing engagement with the administration,” it added.

Last year, Intel received a $8 billion subsidy under the 2022 Chips and Science Act, building more chip manufacturing plants in the United States.