The US government has announced new sanctions against Russia’s two largest oil companies, Rosneft and Lukoil, in a bid to pressure Russia to agree to a peace deal with Ukraine. This is the first time that the current Trump administration has directly imposed sanctions on Russia.

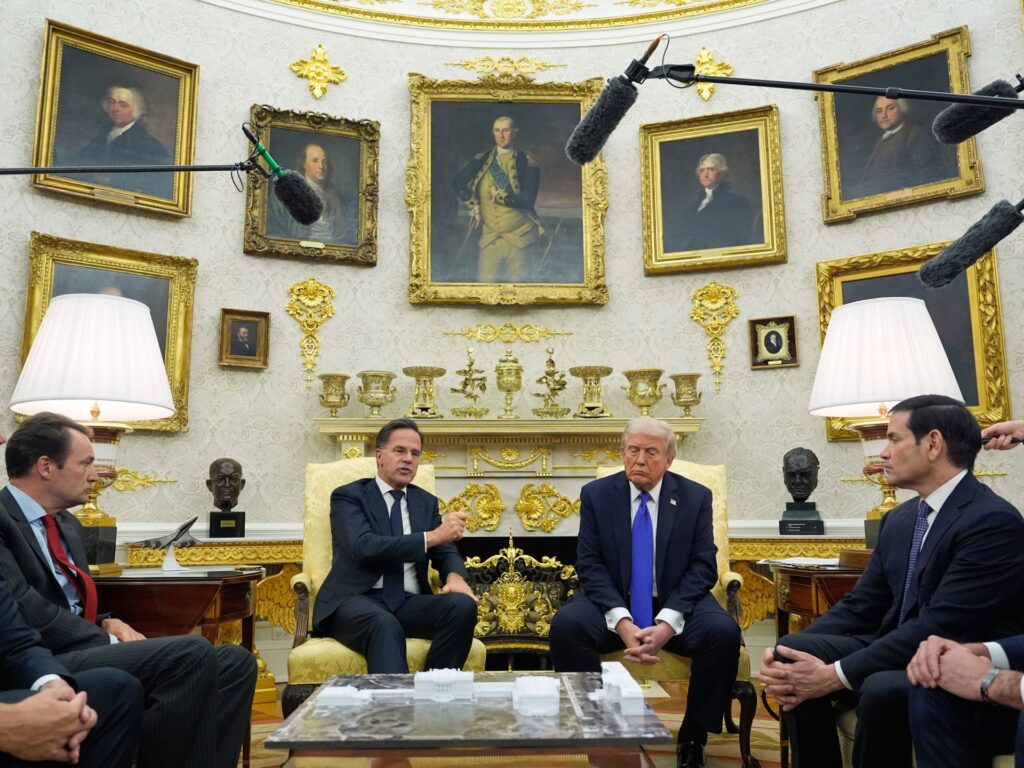

US President Donald Trump, speaking in the Oval Office on Wednesday alongside North Atlantic Treaty Organization (NATO) Secretary General Mark Rutte, said he hoped sanctions would not need to be in place for long, but expressed growing frustration with stalled ceasefire negotiations.

Recommended stories

list of 4 itemsend of list

“Every time I talk to Vladimir (Putin), we have a good conversation, but then they don’t go anywhere. They don’t go anywhere,” President Trump said shortly after a scheduled face-to-face meeting with Russian President Vladimir Putin in Budapest was canceled.

President Trump’s actions are aimed at cutting off essential oil revenues for Russia to fund its ongoing war efforts. Early Wednesday, Russia launched fresh shelling on the Ukrainian capital Kiev, killing at least seven people, including children.

U.S. Treasury Secretary Scott Bessent said the new sanctions were necessary because “President Putin refuses to end this senseless war.” He said Rosneft and Lukoil were financing the Kremlin’s “war machine.”

How were Rosneft and Lukoil sanctioned?

The new measures freeze Rosneft and Lukoil’s assets in the United States and prohibit American companies from doing business with them. Thirty subsidiaries owned by Rosneft and Lukoil were also sanctioned.

Rosneft, controlled by the Kremlin, is Russia’s second-largest company by sales after natural gas giant Gazprom. Lukoil is Russia’s third largest company and the largest non-state company.

Both groups export 3.1 million barrels of crude oil per day, accounting for 70% of Russia’s overseas crude oil sales. Rosneft alone is responsible for almost half of Russia’s oil production, and together they account for 6% of global crude oil production.

In recent years, both companies have been hit by rolling sanctions in Europe and falling oil prices. Rosneft reported in September that its net profit for the first half of 2025 would be down 68% year-on-year. Lukoil reported a nearly 27% profit decline in 2024.

Meanwhile, the UK last week announced sanctions against two oil majors. Elsewhere, the European Union appears set to announce its 19th round of sanctions against Moscow later today, including a ban on imports of Russian liquefied natural gas.

How impactful will these sanctions be?

In 2022, Russian oil groups (including Rosneft and Lukoil) were able to offset some of the impact of sanctions by pivoting exports from Europe to Asia and using a “shadow fleet” of hard-to-detect tankers with no ties to Western financial or insurance groups.

China and India soon replaced the EU as Russia’s biggest oil consumers. Last year, China imported a record 109 million tonnes of Russian crude oil, nearly 20% of its total energy imports. India will import 88 million tons of Russian crude oil in 2024.

In both cases, these amounts are orders of magnitude higher than before 2022, when Western countries began tightening their sanctions regime against Russia. As of the end of 2021, China imported approximately 79.6 million tons of Russian crude oil. India imported just 420,000 tonnes.

President Trump has repeatedly called on the Chinese government and New Delhi to halt energy purchases from Russia. In August, it imposed additional trade duties of 25% on India because it continued to buy Russian crude oil at discounted prices. He has so far opposed similar moves against China.

But President Trump’s new sanctions are likely to put pressure on foreign financial groups that do business with Rosneft and Lukoil, including bank intermediaries that facilitate the sale of Russian crude in China and India.

“Engaging in certain transactions involving the persons named today may place participating foreign financial institutions at risk of secondary sanctions being imposed,” the U.S. Treasury Department’s press release on Wednesday’s sanctions said.

As a result, new restrictions could force buyers to move to alternative suppliers or pay higher prices. While India and China may not be the direct targets of the latest restrictions, they could put further pressure on their oil supply chains and trade costs.

“The important thing here is secondary sanctions,” Felipe Pohlmann Gonzaga, a Swiss-based commodity trader, told Al Jazeera. “Any bank that facilitates Russian oil sales and has exposure to the U.S. financial system could be targeted.”

But he added: “I don’t think this will be the driving force to end the war because Russia will continue to sell oil. There will always be people willing to take risks to break sanctions.”

“These recent regulations will make Chinese and Indian players even more reluctant to purchase Russian oil. Many will not want to lose access to the American financial system. (But) they will not be able to completely prevent it.”

According to Bloomberg, several Indian refinery executives, who requested anonymity due to the sensitivity of the issue, said the restrictions would make it impossible to continue buying crude.

On Wednesday, President Trump said he would raise concerns about China’s continued purchases of Russian crude oil when he meets with President Xi Jinping at the 2025 Asia-Pacific Economic Cooperation Summit in South Korea next week.

Has there been an impact on oil prices?

Oil prices rose after President Trump announced US sanctions. Brent, the international crude oil benchmark, rose nearly 4% to $65 a barrel on Thursday. West Texas Intermediate, the U.S. benchmark, rose more than 5% to nearly $60 a barrel.

However, Pohlmann Gonzaga predicted that “the market will correct from this 5% excess. We must remember that sentiment in the energy market remains negative due to the dark (global) economic backdrop.”