Indian edtech startup Physics Waller ended its first day of listing on a high, with its stock closing 44% higher than its listed share price, showing that the country’s edtech sector still has potential for recovery after years of stagnation.

The company’s stock price was 109 rupees, rising to 161.99 rupees and closing at 156.49 rupees, giving it a valuation of 448 billion rupees (approximately $5 billion). This is significantly higher than the company’s listed valuation of 315 billion rupees (about $3.6 billion) and about 79% higher than its previous private valuation of $2.8 billion as of September 2024.

Physics Wallah raised 34.8 billion rupees (approximately $393 million) in its IPO. Of this, 31 billion rupees (approximately $350.1 million) was made through new share issues, and shares worth 3.8 billion rupees (approximately $42.9 million) were sold by co-founders Alak Pandey and Prateek Boob, who jointly owned about 80% of the company before going public.

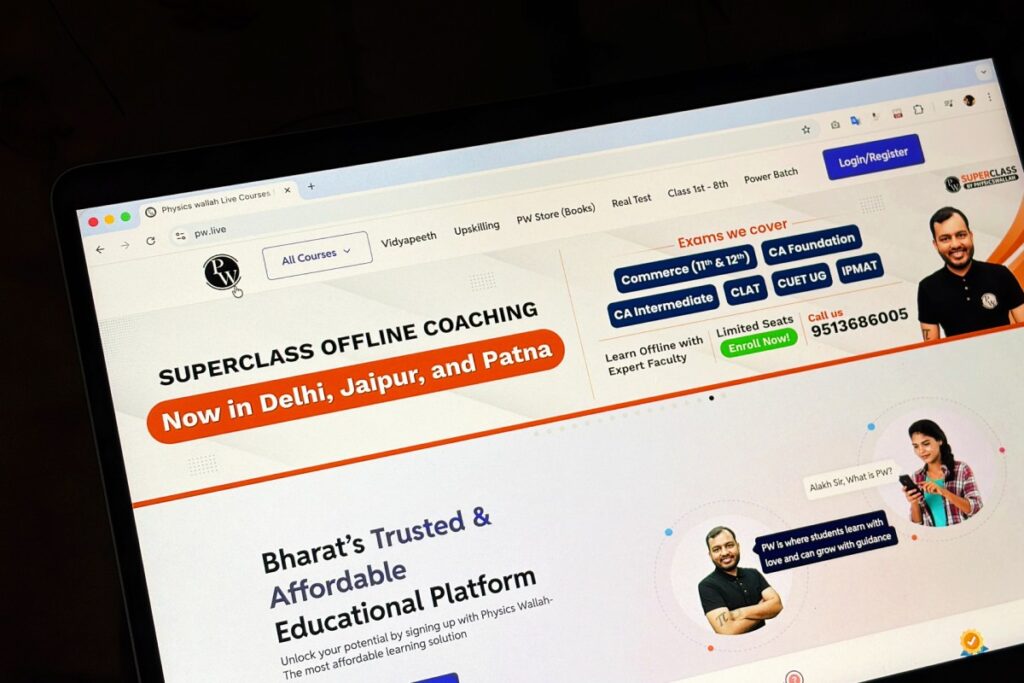

The successful IPO highlights the company’s impressive growth since its humble beginnings as a YouTube channel run by Pandey in 2016. In an industry reeling from layoffs, funding shortfalls and the dismantling of once-celebrated rival Byju, the company now stands out. Currently, the company offers exam preparation and upskilling courses through its website, app, and offline centers.

The company’s rise came at a time when major rivals were struggling to survive. Byju’s, once India’s most valuable startup at $22 billion, is embroiled in a corporate governance crisis, locked in a legal battle with its lenders and grappling with a severe cash crunch that has forced mass layoffs. The Bangalore-based startup is currently undergoing bankruptcy proceedings in both India and the US.

Another high-profile edtech, Unacademy, has also significantly downsized its business and cut staff, and is reportedly in talks to acquire upskilling platform UpGrad for $300 million to $400 million, a steep drop from its 2021 valuation of $3.44 billion.

Physics Waller announced that its revenue for fiscal 2025 rose 49% year-on-year to 28.9 billion rupees (approximately $326 million), while its net loss narrowed from 11.31 billion rupees (approximately $127.7 million) to 2.4 billion rupees (approximately $27.5 million). Online channels accounted for 48.6% of operating revenue, while offline centers accounted for 46.8%. The company also reported that it had 4.5 million paid members, a 23% increase over last year.

tech crunch event

san francisco

|

October 13-15, 2026

“It’s a good milestone for us to go public,” Pandey said at the company’s IPO ceremony in Mumbai. “But that mission and vision leaves much to be accomplished.”

Physics Wallah plans to use the majority of the proceeds from the IPO to expand its offline center, strengthen its technology stack, and fund potential acquisitions. The company is already aggressively expanding its offline footprint, operating 303 centers in 152 cities across India and the Middle East as of June 2025, up from 182 centers last year.