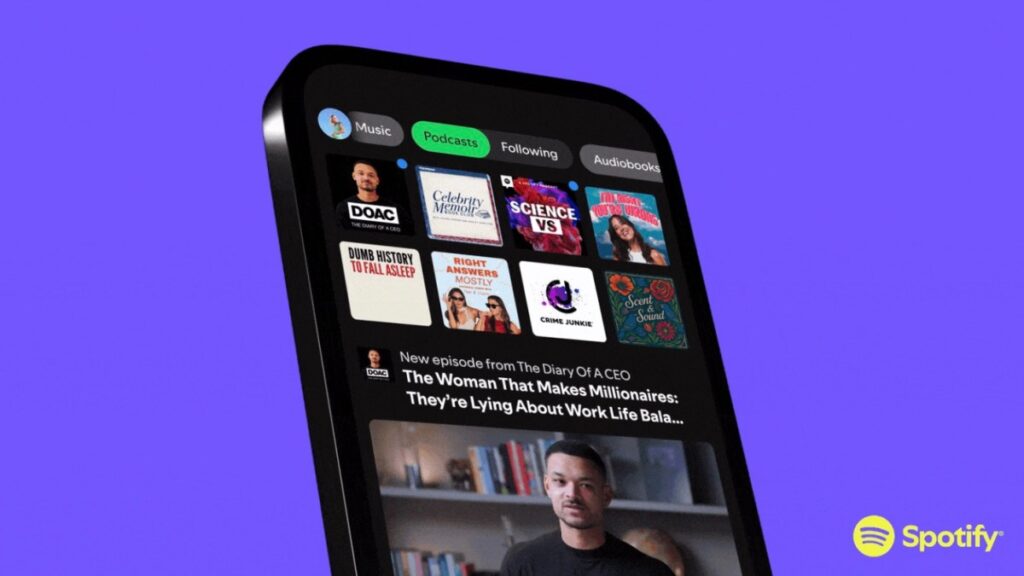

Spotify says its video podcasts are gaining traction with consumers. The company revealed in its third-quarter earnings report that its video podcast catalog has grown to nearly 500,000 shows, with more than 390 million users currently streaming video podcasts on its platform.

This number is up 54% year over year and also reflects Spotify’s increased investment in the format. In June 2024, the company rolled out a tool that allows unhosted podcasters to upload videos to the platform, announcing that it has approximately 250,000 video podcasts. The streaming giant also allows users to participate in podcasts through comments, Q&A, and polls, making the app feel more like a social network.

As a result, Spotify announced that the amount of time users spent with video content on Spotify has also more than doubled year-over-year, driven primarily by video podcasts. Additionally, video podcast consumption has increased by more than 80% since the launch of the Spotify Partner Program (SPP) in January. This will enable eligible creators to monetize their shows in new ways, including audience-driven payments from Spotify Premium user engagement.

The company recently announced a partnership with Netflix to bring video podcasts to a wider audience in the U.S. starting in 2026, with more markets to follow. Investors did not ask about the details of the profit sharing agreement at the results conference. But investors wanted to understand how distributing podcasts off the platform would ultimately benefit Spotify.

Incoming co-CEO Alex Norstrom said the move is aimed at centering Spotify as a distribution hub for creators.

“We… believe that when creators win, we win. Creators optimize to create the best shows and interviews, and that’s what they’re really focused on,” Norstrom told investors and analysts. “They wanted to syndicate everywhere, and of course we believe in helping them reach audiences in as many places as possible. This aligns with our core philosophy of being creator-first.”

Co-CEO Gustav Söderström then suggested that allowing creators to participate in both Spotify and Netflix would give the company additional “revenue opportunities.”

“This is the way we think about this: This is part of our ubiquitous strategy, and it’s really important that while we build a great user experience, we also need a very strong offer for creators,” he said.

Norstrom noted that distributing Spotify podcasts on YouTube has increased awareness of the show and its origins, resulting in increased net usage on Spotify. The company expects the same from Netflix.

Additionally, Spotify said that opportunities on TV are also part of this equation, which is why it recently upgraded its Apple TV app. As more people can use Spotify on different platforms, usage will increase, which will help Spotify’s advertising business.

The company also noted that it offers advertisers programmatic access to its audio and video inventory, but acknowledged that 2025 will be a “transition year” for its advertising business, and expects growth to improve in the second half of 2026.

The streamer also announced that monthly active users rose 11% year over year to 713 million, and revenue reached up to 4.27 billion euros (approximately $4.9 billion), exceeding Wall Street expectations. The company posted a net profit of 899 million euros (approximately $1 billion) in the quarter.

However, Wall Street’s concerns over Spotify’s mixed fourth-quarter outlook sent the stock lower after the opening bell on Tuesday.