Novo Nordisk, the maker of blockbuster weight loss drugs, will cut 9,000 jobs amid growing competition in the industry led by US rival Eli Lily.

The Danish pharmaceutical giant announced its cut on Wednesday, marking the largest layoff in Danish history. The restructuring is expected to save 8 billion Danish crowns ($1.25 billion) a year.

Recommended Stories

List of 4 itemsEnd of the list

This occurs amid a change in the company’s C-Suite. Last month, Novo appointed Magiar Mike Dustdal as CEO to replace Lars Flugaard Jorgensen.

Europe’s most valuable and most valuable company has dropped its market capitalization to around $181 billion from its peak of $6500 billion last year. At the time, Novo’s market capitalization exceeded Denmark’s total annual production.

On Wednesday, the company issued its third profit warning this year.

“They need to rekindle investors’ trust with an attractive growth story for the future,” said Lucas Lu, shareholder of Nord Nordisk, Reuters’ News Agency, portfolio manager.

“The obesity market was misunderstood. It was much more consumer-driven than expected, and Novo expanded the complexity of the organization quickly.”

Rise and decline

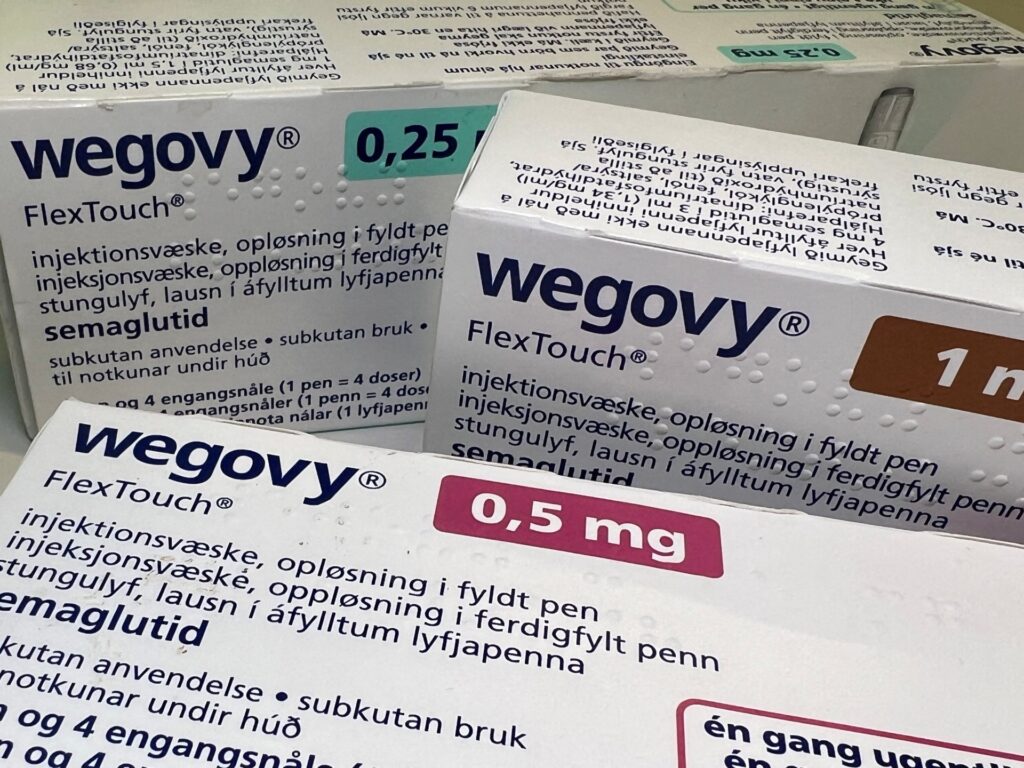

The surge in growth for the Danish Pharma giant began in 2021, when Wegovy was the first highly effective obesity drug approved in the US. Novo Nordisk has nearly doubled its lu count over the past five years amid a surge in growth at the time. This has made it the most valuable company in Europe. This went back and forth with the owners of Moet Hennessy and Louis Vuitton’s LVMH last year.

Based in Bucksvard, just outside Copenhagen, the company has 78,400 workers. Last month it announced employment freezes for non-essential roles. The new cuts account for 11.5% of the company’s workforce, resulting in at least 5,000 cuts from the Danish workforce. Novo Nordisk refused to specify which business units will be affected.

In July, Novo lost its market value of $700 billion as it warned of a profit hit amid increasing competition in the once dominated market.

Analysts at Bank of America said they hope Novo will issue a fourth profit warning when reporting its third quarter results in November.

Novo is trying to increase production to meet the increased demand for its products, prepare a Wegovy pill version, and investigate the additional health benefits of its glucagon-like peptide-1 (GLP-1) portfolio.

The company plans to save at least 1 billion Danish crowns ($157 million) in the fourth quarter, which will redirect to research and development, manufacturing expansion and improving patient access worldwide.

“We need to do best in class launches, especially with increasing competition,” Doustdar said in a call with reporters. “We want to avoid spare dimes.”

“This is the first major move for a new CEO to simplify the structure of Novo and redirect resources towards the growth of diabetes and obesity,” said Michael Novod, head of equity research at Denmark at Nordea Bank.

Intensifying competition

Novo Nordisk faces challenges in selling Vegovi and diabetes medication, especially in the US, as Ozempic begins to lose momentum.

Eli Lilly’s Zepbound overtook Wegovy with weekly prescriptions in the US earlier this year, but Wegovy’s prescriptions began to increase at a faster pace over the summer, narrowing Lilly’s lead in key markets.

Novo’s stock lost its value due to increased competition. Stocks have fallen nearly 46% since the beginning of the year. For that day, inventory was in the positive territory, up 0.4% as of 11:45am (15:45 GMT) in New York.