Nearly seven years after announcing its first fund, Sapphire Sport, a venture fund focused on sports, media and entertainment, has been spun out from Sapphire Ventures. The fund will be rebranded as an independent venture firm, 359 Capital.

The company’s new name pays homage to the feat of breaking the four-minute mile, a feat once thought impossible by humans but ultimately accomplished through sheer dedication and perseverance. 359 Capital Co-founder and managing partner Michael Spirito said the name reflects the firm’s core principle of helping portfolio founders achieve the impossible.

Spirito said separating from Sapphire Ventures, an investment firm with about $11 billion in assets under management, was always on his “vision board.” “We’re all grown up and ready to leave the house.”

Sapphire Sport is currently in the process of investing in its second $181 million fund, but has always maintained a group of limited partners separate from Sapphire Ventures. All of the company’s LPs have deep ties to the sports industry, including major corporations such as City Football Group, Adidas, AEG, Madison Square Garden, and Sinclair, as well as dozens of team owners.

“When we started in 2019, the name Sapphire Sport wasn’t just alliterative and sounded cool,” Spirito said. “Sports captured the LP group.”

Spirito said sports-focused LPs still use their relationships with the company to gain insight into emerging technology companies across the media and sports worlds.

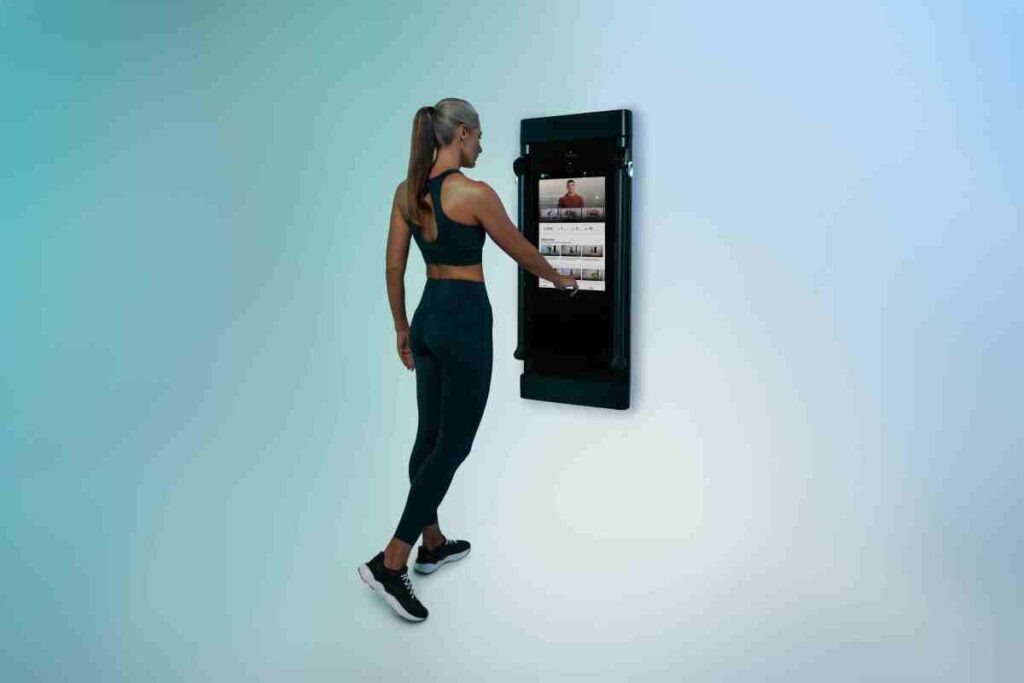

Startups backed by 359 Capital include Beehiiv, a creator-focused newsletter;Online casino, Betty Labs. Sports media platform. Overtime, AI search engine. Perplexity, a successful AI browser. Home gym system “Tonal”.

tech crunch event

san francisco

|

October 13-15, 2026

The firm’s entire portfolio of 30 companies and its entire investment staff will be transferred to 359 Capital. Transition staff includes Spirito, Sapphire Ventures co-founders David Hartwig and Doug Higgins, and newly promoted partner Rico Mallozzi.

As 359 Capital, the company will continue to focus primarily on Series A and Series B startups, writing checks between $2 million and $10 million. The company will continue investing from the second fund through the first half of 2027, Spirito said.

359 Capital will be competing for attention in the world of sports-focused venture capital. Courtside Ventures, backed by Shaquille O’Neal and Michael Jordan, The company is in the process of raising a fourth fund of $100 million, according to an SEC filing.