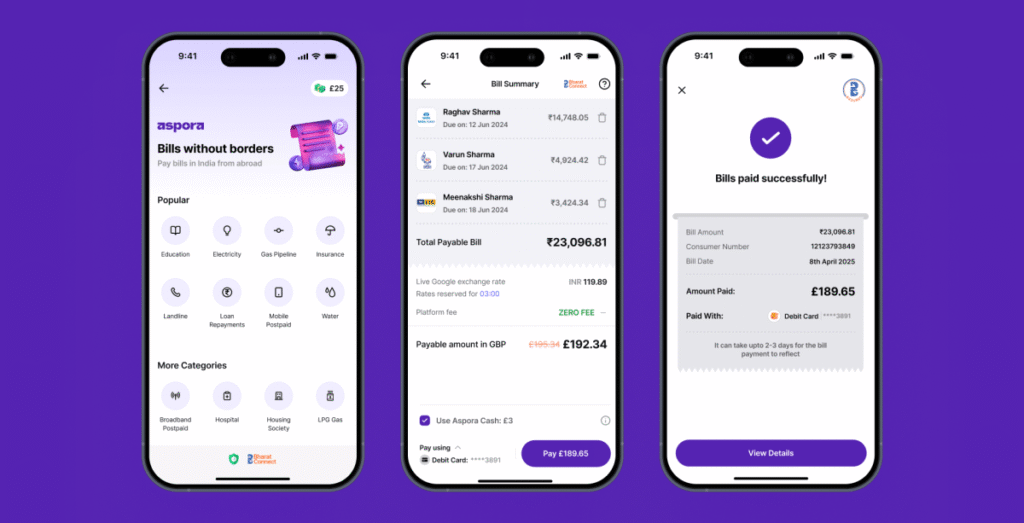

Sequoia-backed fintech platform Aspora, which enables Indian diaspora to send money to India, is launching a new feature for users to pay their bills. This means Non-Resident Indians (NRIs) can now pay utility bills and recharge mobile prepaid plans for their families.

The company said that previously users had to send money to an account in India or have someone else handle the bill for them. Another option for them was to try to pay their bills using foreign cards, facing high bills and insolvency.

Aspora tapped Yes Bank’s domestic pipeline to connect to the Bharat Bill Payment System (BBPS), which processes bill payments in India. Through this system, payments to over 22,000 billers in India have been made possible, ranging from power providers like BSES and BESCOM, broadband providers like Jio and Airtel, to loan payments from major banks.

The company said it doesn’t charge fees for these payments and users can take advantage of the best exchange rates to pay their bills directly in foreign currencies.

“For millions of Indians living abroad, paying bills in India has always been unnecessarily complicated, with transfers, delays, and double fees. Aspora has solved this massive problem with the tap of a button,” Aspora founder and CEO Parth Garg told TechCrunch in a recent phone interview.

Garg said remittances may decline due to bill payments, but the decline would be only 4-5% of total remittances. Garg believes that offering users the ability to pay their bills will create long-term sustainability.

“Today, Neobank’s goal is to try to get more transactions on the app. For money transfers, people used to use the app once or twice a month, thanks to this new bill payment system. The new features have increased speed on our platform and encouraged users to visit the platform more often,” Garg said.

tech crunch event

san francisco

|

October 13-15, 2026

He said Aspora has been testing the feature with thousands of users for several weeks and has seen positive results. The startup noted that mobile recharging was a big use case that emerged from this test. BBPS does not support some categories such as mobile recharge and credit card payments for foreign payers. Therefore, Apsora has partnered with international mobile recharge company Ding to facilitate these transactions.

The feature is available to customers in the UK, but the company plans to make it available to users in the US and United Arab Emirates (UAE) soon.

In June, Aspora raised $50 million in Series B funding led by Sequoia at a valuation of $500 million. Other investors Greylock, Hummingbird, Quantum Light Ventures, and Y Combinator also contributed to the round. The company has raised more than $99 million in funding to date. The startup opened its services to NRIs in the US market in July. The US market accounts for India’s largest inward remittance market, with a market share of nearly 28%, according to the country’s central bank.

The company says Aspora now has 800,000 customers, has made $4 billion in transactions, and saved $25 million in transfer fees.

Next year, Aspora aims to launch an NRE (Non-Resident External) account, which will allow users to manage their overseas earnings, and an NRO (Non-Resident Ordinary) account, which will allow users to manage their income earned in India.