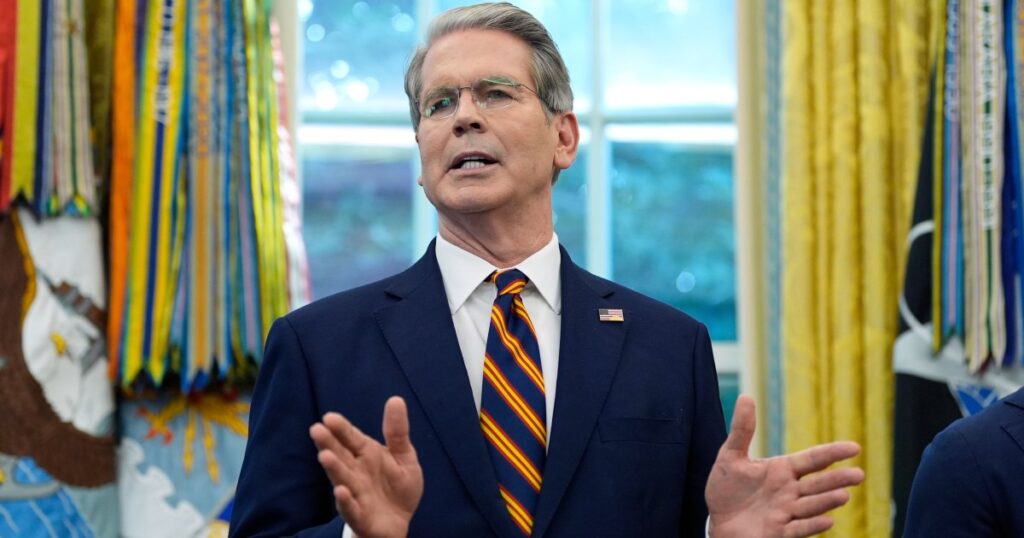

The Treasury Secretary said he is considering measures to stabilize the Latin American country amid the sale of assets.

Released on September 23, 2025

President Donald Trump’s administration has offered to intervene to support Argentina’s economy amid severe volatility in the country’s financial markets.

Washington is ready to do what it takes to stabilize Latin America’s economy following a massive sale of assets, U.S. Treasury Secretary Scott Bescent said Monday.

Options to support Buenos Aires under consideration include exchanging central bank currency, purchasing direct currency, and purchasing government debt sected by the US dollar, Bescent said.

The Treasury Secretary said details will be released after New York’s President Trump, Bescent and Argentine President Javier Miley were involved on Tuesday.

“The opportunities for private investment remain vast and Argentina will be great again,” Bescent said in X, describing Buenos Aires as a “systematically important US ally.”

Argentinean pesos, stocks and bonds rose sharply following Bescent’s comments.

Mairay, who won election upset by committing to tame the out-of-control inflation and decades of economic decline in 2023, thanked the Trump administration for its “unconditional support.”

“We, who defend the idea of freedom, must work together for the happiness of our people,” Mairay said in X.

The Argentine leader has emerged as a major Trump ally in the Americas, and is a favorite of US conservatives and frequently appears on their platforms.

The Trump administration’s intervention comes after investors rushed to drop peso and government bonds following a disastrous performance by Miley’s La Livatado Avanza Coalition in local elections earlier this month.

The loss in Buenos Aires surprised Mairay’s prospects in the national midterm elections next month. The libertarian leader hopes he has given him an expanded mission to pursue a right-wing economic reform programme.

In April, Argentina secured $42 billion in relief funds from the International Monetary Fund, the World Bank and the Inter-US Development Bank to support its economy.

The Latin American country, which has surged during the economic crisis for decades, is the IMF’s biggest debtor, with Washington-based institutions weighing more than $400 billion.