As investors around the world flocked to the asset over the past year, gold prices have skyrocketed to historic highs, exceeding $4,000 per troy ounce (31.1 grams).

Gold futures, a contract to buy and sell gold at certain prices, exceeded the standard on Tuesday, followed by spot gold prices in Asia on Wednesday afternoon.

Recommended stories

List of 4 itemsEnd of the list

Gold has long been considered a “safe asset” that is preferred in times of uncertainty as a physical commodity that can be owned and stored.

But analysts say the rise in recent months has been more dramatically changing: that is, gold may finally break out of its shell and become an “asset that can be used in any situation.”

What happened to gold prices this year?

Gold prices have risen by more than 50% since the beginning of 2025 due to the historic rise of the asset.

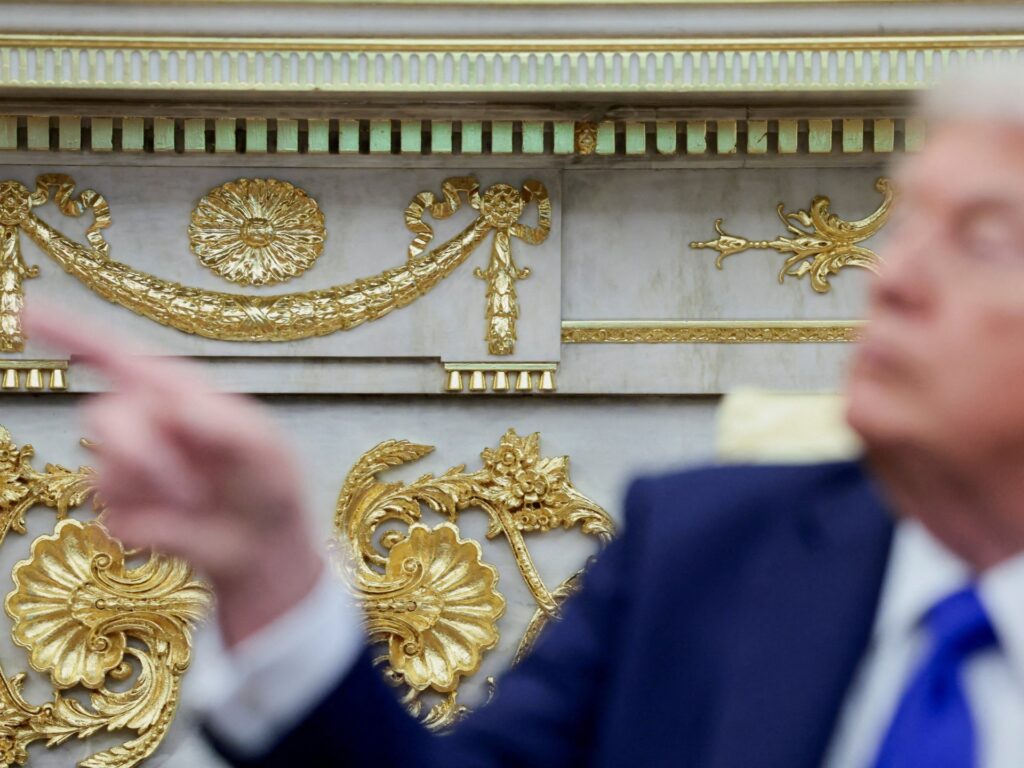

Much of the surge was accelerated by US President Donald Trump, who returned to the White House at the beginning of the year.

Gold prices skyrocketed in April when President Trump launched a trade war against many countries around the world, and again rose in August as the US president attacked the independence of the Federal Reserve (US central bank).

Due to the high uncertainty, many investors have turned to more reliable assets such as gold.

However, President Trump’s tariffs and the fight against the Fed are not the only factors that have continued to move gold prices upward. The growing political crisis in France following the weekend’s election of Japan’s leadership, US government shutdown and Prime Minister Sebastian Lecorgne’s resignation, analysts say.

What is behind the rise in prices this week?

Kyle Rodda, senior financial market analyst at Australia’s Capital.com, told Al Jazeera that Takaichi Sanae’s unexpected victory in Japan’s LDP leadership played a major role in the uptick this week.

In addition to aggressive fiscal deficit spending, Takaichi is expected to become the next prime minister of Japan, the world’s fourth largest economy, with policies such as tax cuts to promote economic growth and household benefits.

Her victory has upset the market as the yen, another “safe asset” for some investors, fell to a 13-month low on Tuesday. According to Reuters. Apparently money has become a reliable alternative.

“The rise we’ve seen this week is… part of the so-called ‘run-it-hot’ deal,” Rodda told Al Jazeera.

How does gold prices rise this year compare to recent years?

The rise is dramatic.

Gold prices usually rise during uncertain times, then stabilize and rise again when the economy becomes unpredictable.

For example, between June 2020 and February 2024, gold prices fluctuated between $1,600 and just over $2,100 per ounce without going too far.

Gold prices rose by about 30% more in 2024. However, as gold prices rose sharply, even that rise significantly surpassed the first nine months of 2025.

Has money ever risen so much?

Gold has hit a historic high this year, but this is not the first time that gold assets have experienced a massive rise.

It is well known that gold prices rose in the 1970s after US President Richard Nixon abolished the conversion of dollars and gold.

The US State Department’s Office of Historians said that gold was set at $35 per ounce after World War II, but the Nixon administration believed the dollar was overvalued due to “a surplus of dollars from foreign aid, military spending and foreign investment.”

Gold prices rose from $35 per ounce in 1971 to $850 per ounce by 1980.

The 1970s were particularly turbulent decades, with economic challenges like the 1973 oil crisis. A major surge occurred following the Soviet invasion of Afghanistan in 1979 and the Iran-US hostage incident in the same year.

What’s the difference this time?

While preference for money could suggest economic unrest, this time it is moving in sync rather than rebelling against the US stock market.

The S&P 500 and Nasdaq Composite index both closed at record highs on Monday amid concerns about US government shutdowns as gold prices rise to record highs this week, according to CNBC.

Tim Waterler, principal market analyst at Australia’s KCM Trades, said the index has been falling since then, but the overall trend is that gold has been considered the first choice investment destination.

“What we’re seeing is that gold is in many respects a ‘asset in every way’ and shows precious metals’ ability to rise during both risk aversion and risk appetite, while at the same time, it continues to act as a hedge of uncertainty for investors, given the presence of geopolitical risks both within and outside the United States.”

“As a result, gold is no longer considered solely as a defensive investment strategy. Now, considering the dynamics of the general market, gold is a much broader investment asset,” he added.

What does this say about Trump?

Waterler and Rodda told Al Jazeera that Trump continues to influence long-term gold prices, but he is just one of many factors.

Rodda said gold became a “five-factor” deal.

He said investors are weighing fiscal policy and government debt growth like Japan against ongoing geopolitical risks, US trade policy, threats to the Federal Reserve, and expectations that the US will cut interest rates in the future.

“As far as it relates to President Trump, I think I can say he has a strong influence on money. His trade policy, his fiscal policy, his attack on the Fed are all the factors. But I don’t think that’s necessarily a denial of President Trump in particular. There are a lot of factors involved,” Rodda said.